For consumers

The content of this website is also available here in ppt format

- About natural gas

Natural gas is a colourless, odourless, highly flammable, gaseous, fossil fuel consisting primarily of methane (CH4), but also containing small amounts of other hydrocarbons. It was formed over millions of years from organic matter, such as ancient plant or animal remains (known as fossils) and is found beneath the earth's surface and under the seas.

Natural gas is considered the least polluting fossil fuel because it produces less carbon dioxide, sulphur dioxide, nitrogen oxide and particulate matter when burned than coal or oil. In addition, it has a higher hydrogen/carbon mass ratio, which means that more energy is released during combustion, making it more efficient in terms of energy production. Nevertheless, the use of natural gas should also be seen in the context of reducing greenhouse gas emissions and switching to more sustainable energy sources.

Natural gas is traditionally extracted by drilling from underground reservoirs (natural gas fields), often located next to oil deposits. Non-traditional forms of natural gas are shale gas and tight gas, both extracted from clay shale formations by hydraulic fracturing. Coalbed methane comes from coal deposits and is usually extracted in conjunction with coal mining operations. Methane hydrates are still in the exploration phase but may be a promising source of natural gas in frozen form in deep-sea sediments or permafrost areas.

Another potential source of natural gas is renewable biomethane, which is produced by the anaerobic digestion of organic materials such as sewage, agricultural waste or landfill gas. This biogas is mainly composed of methane and carbon dioxide, but it must first be purified from its other components before it can be injected into the natural gas network.

Natural gas has a wide range of uses, which make it a valuable energy source: electricity generation, heating, cooking, industrial use, feedstock for various chemicals and fertilisers, or LPG fuel.

- Supply chain for natural gas

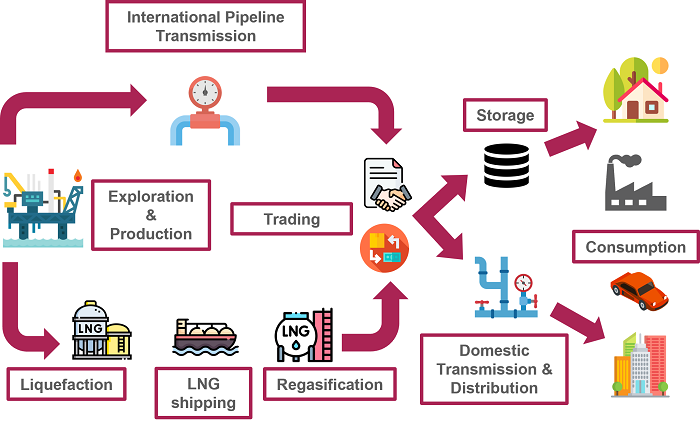

The main stages of the natural gas supply chain are the following.

1. Exploration and extraction: Exploration involves identifying potential gas reserves through geological and seismic measurements, as well as test drilling. Following the discovery of a gas field, extraction can commence. Conventionally, natural gas is extracted by drilling wells into underground deposits. Unconventional sources such as shale gas require techniques like hydraulic fracturing.

2. Processing: Raw natural gas often contains other components such as water, sulphur compounds, and other impurities. Processing plants remove these contaminants to ensure that the natural gas meets quality standards and is suitable for transportation and use. The processing may include the removal of water, the separation of natural gas liquids, and the reduction of sulphur content.

3. Transportation: Natural gas is transported primarily via pipelines or in the form of liquefied natural gas (LNG). High-pressure pipelines transport the gas from production sites to major distribution points, where it is then transported to local distribution networks or directly to end-users. In cases where pipeline transportation is not feasible, the natural gas is cooled to such a low temperature that it becomes liquefied, making it transportable in specialized tanker ships. Upon arriving at ports, the gas is regasified at dedicated terminals before it enters the pipeline network.

4. Trading: Natural gas is typically bought and sold on exchanges by trading companies in an anonymous manner, but two companies can also trade with each other directly, in the form of bilateral contracts, also known as OTC (“Over-the-counter”) trading.

5. Storage: Natural gas is stored in underground facilities (such as underground gas reservoirs and salt caverns) for future use, ensuring adequate supply and balancing seasonal demand fluctuations. During periods of low demand (for example, in the summer), the gas storages are filled, and during periods of increased demand (for example, in the winter), it is withdrawn from storage.

6. Distribution and Use: Through the distribution network, natural gas is transported via pipelines of various sizes to end-users, including residential, commercial, and industrial consumers. Local gas distribution companies play a crucial role in delivering the gas to consumers, ensuring its safe and efficient use.

- Hungary's main supply routes

Due to Hungary’s geographical location and available infrastructure, it is situated at a key hub of Central and Eastern European pipelines. Despite the cessation of natural gas supplies from Austria and Ukraine in 2023-2024, Hungary still receives gas from three other countries. Starting from 2021, the southern infrastructure, namely the Turkish Stream’s land extension, reaches Hungary from Serbia, with the majority of gas imports coming from this direction. In the past year, Romania became the second-largest source, with the gas supply mainly coming from significant Romanian production. The third most significant supply comes from Croatia, through the Krk LNG terminal, with expected infrastructure developments by 2026-2027 that could increase imports. No other country in the region has as many cross-border pipelines as Hungary, which enhances supply security.

Among Hungary’s seven neighboring countries, six have pipeline connections with Hungary:

Austria: This route connects Hungary to Western Europe, with a significant historical route from Ukraine-Slovakia-Austria to Hungary originating from Russia. The pipeline enters Hungary at Mosonmagyaróvár, with a capacity of 153 GWh/day. From the end of 2023, supplies from Austria ceased, and all Russian-origin natural gas now enters Hungary via Serbia. The cross-border connection is one-way, so there is no outgoing capacity from Hungary to Austria.

Croatia (LNG): The closest liquefied natural gas (LNG) terminal to Hungary is located in Croatia, capable of receiving tanker ships from anywhere in the world, including from America, Africa, and Asia. It began operations on January 1, 2021, on Krk Island. The LNG terminal can supply up to 85.5 GWh of gas per day to the Croatian transmission network. The pipeline enters Hungary at Drávaszerdahely, with a capacity of 51 GWh/day, and the pipeline leaving Hungary has a capacity of 77 GWh/day.

Serbia (Turkish Stream): Since 2021, natural gas from Russia also reaches Europe through Turkey, entering Hungary via Bulgaria and Serbia at Kiskundorozsma. This route can bring gas from Azerbaijan or Turkey as well. The Turkish Stream pipeline ends in Hungary, with a capacity of 246 GWh/day entering Hungary, and 142 GWh/day exiting. The annual gas supply from this route amounts to 4.5 billion cubic meters under the long-term Russian-Hungarian gas contract signed in 2021.

Romania: Romania has significant natural gas production, part of which is exported to Hungary, and potentially even more in the future due to Romania’s significant Black Sea gas reserves. Gas enters Hungary through Csanádpalota, with a two-way capacity of 78 GWh/day.

Ukraine: Historically, the largest amounts of natural gas arriving in Hungary came from Russia via Ukraine, as long-term contracts between the two countries utilized this route. However, the Turkish Stream has now replaced this route. The capacity for incoming gas at Beregdaróc is 525 GWh/day, but currently, gas is mostly flowing out from Hungary, with an exit capacity of 86 GWh/day.

Slovakia: The significance of the Balassagyarmat border crossing has increased in recent times. Due to high utilization, the capacity from Hungary to Slovakia was increased twice in 2024, now reaching 101 GWh/day. The incoming capacity is 129 GWh/day.

The FGSZ interface can be used to monitor daily inflows and outflows.

In addition to incoming sources, it is crucial to note that natural gas consumption is seasonal, requiring storage. Compared to some other EU member states, Hungary can store a significant amount of gas, totaling 67 TWh, across five physical storage facilities (Szőreg, Pusztaedericse, Zsana, Kardoskút, and Hajdúszoboszló). This storage capacity is the sixth-largest in the EU. Typically, the summer period is used for storage, with withdrawals occurring in winter based on daily demand (temperature, consumption) and withdrawal capacity.

EU gas injections can be monitored on the AGSI website.

- Why are gas exchanges important?

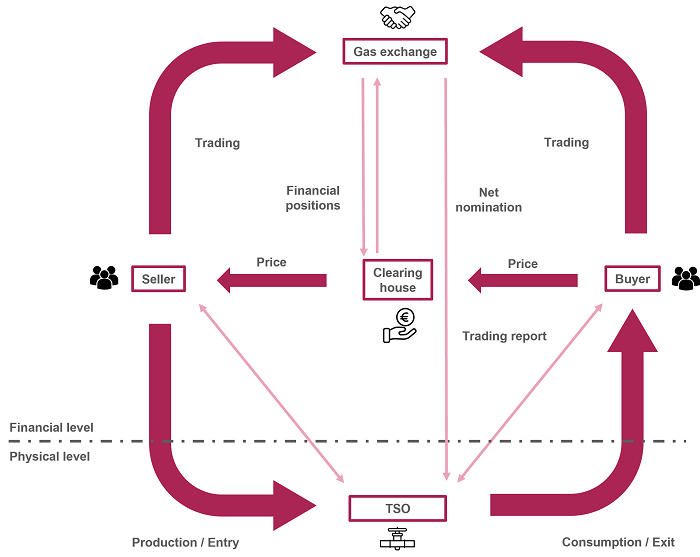

Gas exchanges serve as trading platforms - natural gas is typically bought and sold on exchanges by market participants (producers, transporters, consumers, etc.), the exchange itself only provides the platform for it.

A gas hub means a physically well-connected country or region that serves as the delivery location of products, such as the Dutch Title Transfer Facility for natural gas (TTF) or the Hungarian Virtual Point (MGP).

In contrast to direct bilateral (OTC) trading, exchanges create a platform where multiple market participants can trade anonymously and without discrimination. Consequently, deals are concluded at the best available prices, based on supply and demand dynamics. In other words, a transaction is concluded when one of the multiple offers to sell and one of the multiple offers to buy are matched at the same price level, so that both the seller and the buyer are trading at the right price and neither market participant is advantaged or disadvantaged by the acceptance of the offer.

Transparent matching mechanisms enhance market efficiency and competition. On one hand, gas hubs encourage market players to compete on equal grounds leading to more efficient pricing. On the other hand, efficient markets attract investment, while hub prices serve as an important reference allowing participants to assess market trends, optimize their trading strategies, and make investment decisions.

Inclusion of a clearing house helps mitigating counterparty risk. The clearing house ensures that even if one party defaults on their contractual obligations, the other leg of the transaction is still concluded. Defaulting members generally face suspension or exclusion, but other members are protected by the guarantees and collaterals paid to the clearing house.

Gas exchanges operate under strict regulations, aligning with policy objectives aimed at fostering competitive and sustainable energy markets. They offer a regulated framework where energy policy initiatives, such as supporting renewable sources or cutting greenhouse gas emissions, can be integrated.

Energy exchanges enable cross-border trading and foster liquidity, contributing to market integration and regional market linkage. Increased market integration and liquidity facilitate diversification, enhancing supply security for consumers. In simpler terms, they allow market participants to decrease their dependence on a single source or route. Exchanges also bolster market flexibility, allowing adjustments in supply contracts, storage levels, and trading strategies based on price signals and market opportunities. Gas hubs further stimulate infrastructure development, enhancing the general flexibility and reliability of the gas market.

CEEGEX has been operating the organized Hungarian natural gas market for over ten years. Approximately 60 members from 15 different countries trade on the platform, and in 2024, more than half of domestic consumption was traded on it. In 2021, ACER (European Agency for the Cooperation of Energy Regulators) classified the Hungarian market as an emerging market. CEEGEX is a Trading Platform under Regulation 312/2014/EU of the European Commission, providing a platform where the transmission system operator can trade to implement balancing measures.

- Operation of the gas exchange

The gas exchange offers a platform where members can execute their buying and selling activities in an anonymous, non-discriminatory manner. The exchange allows for the trading of standardized products, each defined by specified attributes like gas quality, delivery location, and delivery time. The applied platform is a well-known IT solution, compatible and possible to integrate with other trading platforms. Similarly, to other virtual gas hubs, the Hungarian virtual trading point (MGP) offers unlimited trading, giving members the flexibility to inject and withdraw gas from the transmission system at their convenience within the country. The clearing house acts as a financial intermediary, managing member accounts and enforcing trading limits. The transmission system operator (TSO) ensures the physical delivery of natural gas, checks the quantities traded on the gas exchange and the correctness of the quantities fed into and withdrawn from the network. Members can be wholesale traders, natural gas producers, network operators and even consumers. Every member has the right to buy and sell.

A list of fully licensed traders in Hungary (traders supplying consumers) is available on the MEKH website.

- 4+1 key facts about CEEREP, the Hungarian gas price index

1. Why are price indices important?

- The price indices published by the exchanges ensure transparency in the markets, as they are available to all market participants. An index is compact - it summarizes the entire trading day in the form of a single price, serving as an important reference point. Thanks to their simple and objective calculation logic, they also act as reliable sources of information that support decision-making.

2. What is CEEREP and how is it calculated?

- CEEREP is a new end-of-day activity-based index, introduced by CEEGEX in March 2023, that accurately reflects the Hungarian gas market (MGP) at the end of each working day. The index is unique in that its calculation relies exclusively on the bids and trades executed on CEEGEX, in contrast to many other indices that also consider non-Hungarian market data. CEEREP follows European best practices in terms of algorithms and parameters. As a result, CEEREP serves as a benchmark comparable to European end-of-day natural gas indices, enhancing the usability of CEEGEX prices relative to other MGP prices. The detailed methodology is available on the CEEGEX website.

3. What can CEEREP be used for?

- CEEREP can be freely used by anyone for internal calculations (not for redistribution or publication), as well as for accounting for transactions that are made outside of organized or regulated markets. This makes it particularly useful as a pricing benchmark in bilateral natural gas trading contracts. In other words, it can be directly applied in wholesale contracts and can also be incorporated into consumer contracts.

4. Where is CEEREP available?

- CEEGEX publishes the CEEREP index for a given gas day after 17:30 (CET) before delivery.

+1 Why is it important to include a Hungarian gas price index in Hungarian contracts?

For years it has been common that consumers receive offers including either fix prices, front month indexed prices, spot prices or a mixture of these. From the client’s perspective the fix price results the most predictable cashflow, while the spot price is the most unpredictable. Talking about risks the front month index is somewhere in between. Nonetheless, a flexible price index leaves the possibility to benefit from falling prices. The mixed formula is less common but combines the advantages of the other two pricing modes: a given percentage of the total volume is priced at a fixed rate, the remaining volume is priced at a flexible rate that can track market prices.

In the summer of 2022, due to the energy crisis, fixed-price formulas were typically phased out of consumer contracts, with primarily indexed formulas taking their places. In practice, in Hungary the price for the front month is based on TTF, while spot prices follow the formula of either Dutch TTF + spread or Austrian VTP + spread. Recently, the Hungarian Virtual Point (MGP) is also gaining ground.

An important factor is that while natural gas markets are globally connected, local events can also shape prices. For instance, lower LNG flows or Norwegian exports can significantly affect TTF and VTP prices, while the MGP price may be more resilient due to stable southern supply. If the contract price with the consumer is indexed to the same index which is the supplier’s source, then the supplier is not bearing spread risk. The way to switch to the MGP was opened up by making price differences between countries (spreads) hectic.

By 2023 mainly those prudent suppliers were able to survive who had a responsible risk strategy, which is also crucial from the point of view of security of supply. Concepts previously unknown to consumers became the new norm, and CEEGEX-indexed consumer contracts also appeared. This latter is more beneficial both from the perspective of the consumer and the supplier, as it enables pricing that reflects domestic supply and demand conditions, that is the contract price can be to some extent separated from factors influencing foreign prices like e.g. fundamentals affecting TTF.

If a gas supply contract includes full or partial spot indexation, CEEGEX prices are the best solution in Hungary instead of TTF DA or VTP DA prices.

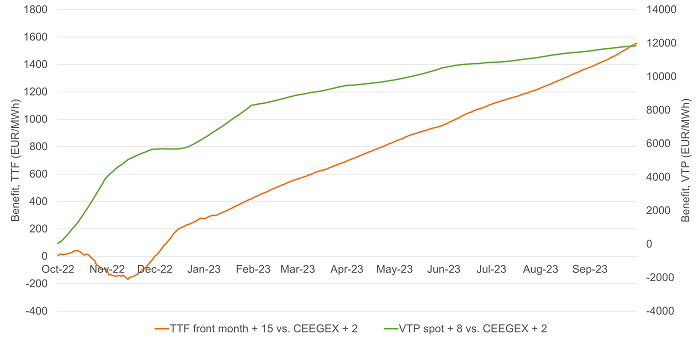

Based on CEEGEX's internal analysis, in the first 10 months of ’22/23 gas year the cost of a consumer was significantly more favourable with a contract linked to CEEGEX than with TTF or VTP indices.

The analysis investigated the cumulative profit/loss of the CEEGEX-indexed contract relative to VTP- and TTF-indexed ones. The conclusion was that while at the beginning of the gas year, TTF-indexing was the most advantageous, from November on (or compared to VTP, from October) locally indexed contracts performed better.

CEEGEX encourages market participants to use the newly launched CEEREP index or the volume weighted average price (VWAP) in the bilateral contracts, especially towards consumers.